jueves, 28 de enero de 2016

miércoles, 27 de enero de 2016

Lolly makers cave to social media campaign, again

IF there’s one thing social media has taught us in recent times, it’s that if you whinge about something persistently enough, someone else might just do something about it.

And nowhere has this been more true than in the confectionery industry.

The past six months alone have seen social media-based campaigns conquer to bring back shelved favourites jelly tots, and even have Golden Gaytime ice cream welcomed to our fridges encased in tubs.

And quicker than dessert producers could figure out whether they were engaging in clever marketing or simply indulging bratty behaviour, sweet-toothed keyboard warriors were at it again.

This time they’re campaigning to free their favourite sweets from the confines of party mix packs, and one major lolly brand has caved.

A dedicated fan of gummy peaches & cream was left exhausted and disappointed after rummaging through a large bags of Allen’s lollies only to uncover half-handfuls in of her favourite treat in each pack.

FUENTE: http://www.perthnow.com.au/lifestyle/food/lolly-makers-cave-to-social-media-campaign-again/news-story/86a72c6b46aaae0222cae51802fd7cfd?utm_content=SocialFlow&utm_campaign=EditorialSF&utm_source=PerthNow&utm_medium=Facebook

martes, 26 de enero de 2016

Confitería colombiana apostándole a la salud, en la conquista del mercado australiano con productos innovadores

Enero 27,

Sydney. En Colombia, los confites y chocolates con valor agregado tienen una

participación, muy importante tanto en la producción como en las exportaciones

y son un motor para la economía

colombiana.

Los productos

y formulaciones han ido evolucionando en desarrollos más saludables y rompiendo

paradigmas en torno al azúcar, permitiendo la diversificación con otros

endulzantes.

Australia ha entrado en la lista de los mercados más interesantes para

los productos colombianos. Por esto, si estamos interesados en

exportar hacia ese país debemos saber que hay que tramitar permisos de ingreso,

registro de etiquetas y empaques -entre unos y otros- ante el Departamento de agricultura, pesca e

industria forestal de cuarentena y servicios de inspección australiano (Australian

Quarantine and Inspection Service AQIS). Es muy importante tener en cuenta que

los requisitos de ingreso pueden variar cada año.

Algunos de

los requisitos y/o ventajas legales generales para estos productos azucarados son:

1.

No requiere permiso de importación

2.

No requiere el Quarentine Entry

3.

Los confites no incluyen productos

como postres con lácteos, líquidos, pastas para untar o bebidas cuyas condiciones de importación están descritas

dentro de la categoría de producto lácteo.

4.

Todos los productos deben entrar

acompañados por la documentación requerida por el Departamento de cuarentena e

inspección australiana AQIS

5.

Todos los productos deberán tener una

empresa en el territorio australiano que responda penal y jurídicamente.

6.

Dependiendo del producto pueden

aplicar otros requisitos.

Además, el

etiquetado de los productos debe cumplir con los requisitos del código estándar

para los alimentos, el cual se puede descargar en la página web de Food

Standards Australia - New Zealand www.foodstandards.gov.au

Australia es

un país que se caracteriza por tener un control minucioso de los productos que

se importan para evitar el ingreso de productos tóxicos, virus o especies que

puedan dañar al país, es por esto que las principales barreras arancelarias con

las que se enfrentan los exportadores colombianos son los procedimientos de

aduanas e inspecciones de cuarentena.

Después de

Estados Unidos, Australia es el segundo país con más obesidad. Debido a esto es

que el gobierno australiano ha adoptado campañas contra este flagelo con la estimulación para el desarrollo de la

producción de alimentos más saludables con menos contenidos de azúcar.

Los

supermercados de cadena, los canales de distribución y las tiendas de alimentos

en general informan que los confites son consumidos por diferentes púbicos, convirtiendo este producto en multitarget.

Los precios varían por la cantidad que contiene el empaque y el factor

diferenciador. Se pueden encontrar dulces con un rango muy amplio desde los más

sencillos, pequeños y económicos hasta los más modernos, sofisticados y

costosos.

Las ventajas

comerciales más importantes son:

·

Marca reconocida ( Aunque son muy

abiertos a probar)

·

Compra por impulso

·

Innovación

·

Fuerte estrategia de Marketing

Algunas de

las recomendaciones para entrar al mercado australiano son ofrecer un producto

con un factor diferenciador y valores agregados

con la marca propia o vender el producto sin marca y con un precio más

competitivo a los grandes supermercados para que estos puedan re empacarlo con

su propia marca.

Las

temporadas en que la confitería más se consume es en invierno (junio-agosto) y

en eventos especiales como San Valentín, Semana Santa, Día de la madre,

Halloween y navidad. El australiano no tiene un horario especial para consumir

los confites, los consume a cualquier hora del día.

Las

características de la presentación del producto varían según los requerimientos

del comprador. Pero es vital tener en cuenta tanto para mayoristas como retail:

en inglés, legible, el etiquetado debe ser permanente en una parte visible y si

la etiqueta incluye calidad o peso, se debe indicar si es neto o bruto.

Colombia en

este sector en particular está conquistando nuevos mercados con ventajas a

nivel mundial, ya que produce internamente sus materias primas. Por todo esto es

que las empresas colombianas; están invirtiendo en investigación, innovación,

desarrollo, infraestructura y maquinaria.

Para exportar

de una forma segura las empresas necesitan un ALIADO con un equipo dinámico que

conozca tanto el producto y la cultura colombiana como el mercado australiano,

que los asesore y represente para poder ir a la vanguardia y penetrar el

mercado en forma segura y efectiva.

Es la hora de

romper los mitos!!! Colocar en los mapas de las empresas colombianas Australia

como un destino a corto y mediano plazo. #ESLAHORADEEXPORTAR #ATREVETEAEXPORTAR

Para mas

información…

CARMENZA HOYOS LLANO

KZAGROUP PTY LTD

+61404160852

jueves, 21 de enero de 2016

¿QUÉ ES EL CURSO E-LEARNING PROCOLOMBIA?

Es una herramienta diseñada para los empresarios la cual les permitirá ahorrar tiempo, dinero, aumentar la eficiencia y optimización en el aprendizaje del proceso exportador, a través del curso virtual Prepárese para exportar compuestos por módulos, ayudas didácticas y métodos audiovisuales enfocados en temas de comercio exterior y orientación a la internacionalización de las empresas.

¿QUIÉN PUEDE PARTICIPAR EN LOS CURSOS?

Empresas colombianas legalmente constituidas que estén activas en el sector de agrícola, agroindustrial y manufacturero

¿CUANTOS CUPOS HAY DISPONIBLES?

Se admitirán las primeras 100 empresas que realicen la inscripción y que cumplan los requisitos.

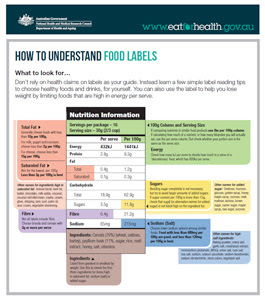

Nutrition information panels

(July 2012)

Nutrition information panels provide information on the average amount of energy (in kilojoules or both in kilojoules and kilocalories), protein, fat, saturated fat, carbohydrate, sugars and sodium (a component of salt) in the food, as well as any other nutrients about which a nutrition claim is made. For example, if a food had a ‘good source of fibre’ claim then the amount of fibre in the food must be shown in the nutrition information panel.

The nutrition information panel must be presented in a standard format which shows the average amount per serve and per 100g (or 100mL if liquid) of the food.

There are a few foods that don’t require a nutrition information panel, for example:

- a herb or spice, mineral water, tea and coffee (because they have no significant nutritional value)

- foods sold unpackaged

- foods made and packaged at the point of sale, e.g. bread made and sold in a local bakery.

However, if a nutrition claim is made about any of these foods (for example, ‘good source of calcium’, ‘low fat’) a nutrition information panel must be provided.

Foods in small packages, i.e. packages with a surface area of less than 100 cm squared (about the size of a larger chewing gum packet) are not required to have a nutrition information panel.

Serving size

The serving size listed in the nutrition information panel is determined by the food business. This explains why it sometimes varies from one product to the next. The ‘per serve’ information is useful in estimating how much of a nutrient you are eating. For example, if you are watching how much fat you are eating, you can use the ‘per serve’ amount to help calculate your daily total fat intake from packaged foods.

Quantity per 100g

The ‘quantity per 100g’ (or 100ml if liquid) information is handy to compare similar products with each other. The figures in the ‘quantity per 100g’ column are the same as percentages. For example, if 20 grams of fat is listed in the ‘per 100g’ column this means that the product contains 20% fat.

Energy/kilojoules

The energy value is the total amount of kilojoules from protein, fat, carbohydrate, dietary fibre and alcohol that is released when food is used by the body.

Protein

Protein is essential for good health and is particularly important for growth and development in children. Generally, people in developed countries eat enough protein to meet their requirements. Meat, poultry, fish, eggs, milk and cheese are animal sources of protein. Vegetable sources of protein include lentils, dried peas and beans, nuts and cereals.

Fat

Fat is listed in the nutrition information panel as total fat (which is the total of the saturated fats, trans fat, polyunsaturated fats and monounsaturated fats in the food). A separate entry must also be provided for the amount of saturated fat in the food.

If a nutrition claim is made about cholesterol, saturated fats, trans fatty acids, polyunsaturated fats, monounsaturated fats or omega -3, omega-6 or omega-9 fatty acids, then the nutrition information panel must also include the amount of trans fat, polyunsaturated fats and monounsaturated fats and also omega fatty acids if claimed.

Carbohydrates

Carbohydrates can be found in bread, cereals, rice, pasta, milk, vegetables and fruit. Carbohydrate in the nutrition information panel includes starches and sugars. Starches are found in high amounts in foods such as white, wholemeal and wholegrain varieties of cereal, breads, rice and pasta, together with root vegetables and legumes.

Sugars

Sugars are a type of carbohydrate and are included as part of the carbohydrates in the nutrition information panel as well as being listed separately. The amount of sugars in the nutrition information panel will include naturally occurring sugars, such as those found in fruit, as well as added sugar. Note that products with ‘no added sugar’ nutrition claims may contain high levels of natural sugars.

Dietary fibre

The nutrition information panel does not need to include fibre unless a nutrition claim is made on the label about fibre, sugar or carbohydrate, for example ‘high in fibre’, ‘low in sugar’.

Sodium/salt

Sodium is the component of salt that affects health and high levels have been linked with high blood pressure and stroke, which is why it is included in the nutrition information panel. Read more about sodium and salt.

http://www.foodstandards.gov.au/consumer/labelling/panels/Pages/default.aspx

miércoles, 20 de enero de 2016

Ingredient lists and percentage labelling

(December 2015)

Ingredient lists

Ingredients must be listed in descending order (by ingoing weight). This means that when the food was manufactured, the first ingredient listed contributed the largest amount and the last ingredient listed contributed the least. For example, if sugar is listed near the start of the list the product contains a greater proportion of this ingredient.

If the product contains added water, it must be listed in the ingredient list according to its ingoing weight, with an allowance made for any water lost during processing, e.g. water lost as steam. The only exceptions are when the added water:

- makes up less than 5% of the finished product,

- is part of a broth, brine or syrup that is listed in the ingredient list, or

- is used to reconstitute dehydrated ingredients.

Sometimes compound ingredients are used in a food. A compound ingredient is an ingredient made up of two or more ingredients e.g. canned spaghetti in tomato sauce, where the spaghetti is made up of flour, egg and water. All the ingredients which make up a compound ingredient must be declared in the ingredient list, except when the compound ingredient is used in amounts of less than 5% of the final food. An example of a compound ingredient that could be less than 5% of the final food is the tomato sauce (consisting of tomatoes, capsicum, onions, water and herbs) on a frozen pizza.

However, if an ingredient that makes up a compound ingredient is a known allergen it must be declared regardless of how much is used.

Percentage labelling

Most packaged foods have to carry labels which show the percentage of the key or characterising ingredients or components in the food. This allows you to compare similar products.

The characterising ingredient for strawberry yoghurt would be strawberries and the label would say, for example, 9% strawberries. An example of a characterising component could be the cocoa solids in chocolate. Some foods, such as white bread or cheese, may have no characterising ingredients or characterising components.

http://www.foodstandards.gov.au/consumer/labelling/ingredients/Pages/default.aspx

martes, 19 de enero de 2016

Nutrition content claims and health claims

(January 2013)

A new food standard to regulate nutrition content claims and health claims on food labels and in advertisements became law on 18 January 2013.

Food businesses must comply with the new standard (Standard 1.2.7) from 18 January 2016.

Nutrition content claims and health claims are voluntary statements made by food businesses on labels and in advertising about a food.

Nutrition content claims are claims about the content of certain nutrients or substances in a food, such as ‘low in fat’ or ‘good source of calcium’. These claims will need to meet certain criteria set out in the Standard. For example, with a ‘good source of calcium’ claim, the food will need to contain more than the amount of calcium specified in the Standard.

Health claims refer to a relationship between a food and health rather than a statement of content. There are two types of health claims:

- General level health claims refer to a nutrient or substance in a food and its effect on a health function. They must not refer to a serious disease or to a biomarker of a serious disease. For example: calcium is good for bones and teeth.

- High level health claims refer to a nutrient or substance in a food and its relationship to a serious disease or to a biomarker of a serious disease. For example: Diets high in calcium may reduce the risk of osteoporosis in people 65 years and over. An example of a biomarker health claim is: Phytosterols may reduce blood cholesterol.

Food businesses wanting to make general level health claims will be able to base their claims on one of the more than 200 pre-approved food-health relationships in the Standard or self-substantiate a food-health relationship in accordance with detailed requirements set out in the Standard. Read more about the notification process.

High level health claims must be based on a food-health relationship pre-approved by FSANZ. There are currently 13 pre-approved food-health relationships for high level health claims listed in the Standard.

All health claims are required to be supported by scientific evidence to the same degree of certainty, whether they are pre-approved by FSANZ or self-substantiated by food businesses. Food-health relationships derived from health claims approved in the European Union, Canada and the USA have been considered for inclusion in the Standard.

Health claims will only be permitted on foods that meet the nutrient profiling scoring criterion (NPSC). For example, health claims will not be allowed on foods high in saturated fat, sugar or salt.

Endorsements that are nutrition content claims or health claims will be permitted, provided the endorsing body meets requirements set out in the Standard.

Standard 1.2.7 – Nutrition, Health and Related Claims will:

- reduce the risk of misleading and deceptive claims about food

- expand the range of permitted health claims

- encourage industry to innovate, giving consumers a wider range of healthy food choices

- provide clarity for the jurisdictions enforcing the Standard.

http://www.foodstandards.gov.au/consumer/labelling/nutrition/Pages/default.aspx

lunes, 18 de enero de 2016

GM food labelling

(August 2013)

Do GM foods have to be labelled?

GM foods, ingredients, additives, or processing aids that contain novel DNA or protein must be labelled with the words ‘genetically modified’. Novel DNA or protein is defined in the Food Standards Code as DNA or a protein which, as a result of the use of gene technology, is different in chemical sequence or structure from DNA or protein present in counterpart food, which has not been produced using gene technology.

Labelling is also required when genetic modification results in an altered characteristic in a food, e.g. soy beans with changed nutritional characteristics such as an increase in their oleic acid content.

GM labelling is not about safety. It is about helping consumers make an informed choice about the food they buy.

All GM foods and ingredients must undergo a safety assessment and be approved before they can be sold in Australia and New Zealand.

The decision on how GM foods are labelled was made by the ministers responsible for food regulation in 2001.

In January 2011, recommendation 29 of an independent review of food labelling recommended that the existing labelling provisions for GM foods should remain. In December 2011, ministers agreed that the existing labelling provisions were appropriate.

Where will I find GM on the label?

You will find the statement ‘genetically modified’ on the label either next to the name of the food, e.g. genetically modified soy beans, or in association with the specific ingredient in the ingredient list, e.g. soyflour (genetically modified). If the food is unpackaged, then the information must be displayed close to the food at the point of sale, for example genetically modified soy beans on a container of loose dried soy beans.

Exemptions from GM labelling

GM foods that do not contain any novel DNA or protein or altered characteristics do not require labelling. A decision not to label these foods was made because the composition and characteristics of these foods is exactly the same as the non-GM food. These foods are typically highly refined foods, such as sugars and oils, where processing has removed DNA and protein from the food, including novel DNA and novel protein.

Flavours containing novel DNA or protein in a concentration of no more than 0.1% are also exempt from labelling.

Labelling is also not required when there is no more than 1% (per ingredient) of an approved GM food unintentionally present as an ingredient or processing aid in a non-GM food. This means labelling is not required when a manufacturer genuinely orders non-GM ingredients but finds that up to 1% of an approved GM ingredient is accidentally mixed in non-GM ingredient.

None of the above exemptions apply if the GM food has altered characteristics.

What about food I buy in restaurants?

Food prepared and sold from food premises and vending vehicles (e.g. restaurants, takeaway food outlets, caterers) is also exempt from GM food labelling requirements. In these cases the food business must supply consumers with information about the product which is not misleading or untruthful.

‘GM free’ and ‘non-GM’ claims

‘GM free’ and ‘non-GM’ claims are made voluntarily by food manufacturers and are subject to relevant fair trading laws in Australia and New Zealand which prohibit representations about food that are, or likely to be, false, misleading or deceptive. More information on fair trade legislation is available from the Australian Competition and Consumer Commission and New Zealand Commerce Commission websites.

Is there a list of GM foods?

FSANZ is responsible for approving GM foods and food ingredients for use in the food supply in Australia. These permissions can be found in the GM standard. We do not maintain a list of food products in the marketplace which contain GM foods, ingredients or processing aids. Retailers or manufacturers may be able to provide this information.

domingo, 17 de enero de 2016

Country of origin labelling

(December 2015)

The Australian Government has proposed a new country of origin labelling system. The new system involves moving country of origin labelling requirements from the Food Standards Code into Australian Consumer Law and introducing additional requirements for ‘priority’ foods.

The Department of Industry, Innovation and Science (DIIS) is consulting on the proposed new system until 29 January 2016. More information is available on the DIIS Consultation Hub.

Requirements for country of origin labelling in Australia

Until the proposed changes to the country of origin labelling system take effect, the requirements in the Food Standards Code and in Australian Consumer Law continue to apply.

Most foods in Australia are required by the Food Standards Code to have country of origin labeling. However, the rules for country of origin claims e.g. ‘product of’ or ‘made in’, are set out in Australian Consumer Law and these claims are regulated by the Australian Competition and Consumer Commission (ACCC).

Food Standards Code country of origin requirements – packaged foods

Packaged food must carry a statement identifying either:

- the country where the food was made, produced or grown; or

- the country where the food was manufactured or packaged and that the food is a mix of ingredients imported into that country or a mix of local and imported ingredients.

The country of origin of the ingredients can also be stated.

Food Standards Code country of origin requirements – unpackaged foods

Country of origin labelling applies to unpackaged fresh and processed fruit, vegetables, nuts, spices, herbs, legumes, seeds, fish (including shellfish) and meat (pork, beef, sheep and chicken).

For example, the following unpackaged foods are required to have country of origin labelling:

- fresh and sun-dried tomatoes

- processed ham and bacon

- fresh and smoked fish fillets, and crumbed fish fillets

- fresh apples and dried apples

- chicken, pork, beef and lamb.

The country of origin of the food must be identified, or, if the food is a mix of foods from different countries, the retailer can state each country of origin or that the food is a mix of local and imported foods, or a mix of imported foods.

For unpackaged food, country of origin information can be written on a sign near the food or on labels, e.g. stickers on fruit.

Are there any exemptions from country of origin labelling?

Some food is exempt from country of origin labelling requirements, including food sold for immediate consumption e.g. food sold in cafes, restaurants and canteens or when a food is made and packaged on the premises it is sold, such as in a bakery.

Does country of origin labelling apply in New Zealand?

Country of origin labelling is voluntary in New Zealand and suppliers may choose not to display this information. When suppliers do include country of origin information, it must be accurate.

All food must be labelled with the contact details of the food supplier in New Zealand or Australia, so you can contact the supplier and ask for details about the food.

http://www.foodstandards.gov.au/consumer/labelling/coo/Pages/default.aspx

miércoles, 13 de enero de 2016

En noviembre de 2015 las ventas externas del país disminuyeron 37,7% con relación al mismo mes de 2014, al pasar de US$3.794,7 millones FOB a US$2.362,3 millones FOB.

Las exportaciones de combustibles y productos de las industrias extractivas registraron una caída de 49,8%, este comportamiento se explicó principalmente por las menores ventas de petróleo, productos derivados del petróleo y productos conexos en -55,8% y hulla, coque y briquetas en -21,1%, que restaron en conjunto 48,2 puntos porcentuales a la variación del grupo. El grupo de manufacturas disminuyó sus exportaciones en 19,5%. Lo que obedeció principalmente a la caída en las ventas externas de manufacturas de minerales no metálicos en -45,0 %; plásticos en formas primarias en -30,9%; ferroníquel en -34,2%; maquinarias especiales para determinadas industrias en -55,1% e hilados, tejidos, artículos confeccionados de fibras textiles, y productos conexos en -37,3 %. Los cinco contribuyeron en conjunto -11,0 puntos porcentuales.

Los productos agropecuarios, alimentos y bebidas pasaron de US$637,7 millones en noviembre de 2014 a US$511,3 millones en el mismo mes de 2015, lo que representó una caída de 19,8 %. Esto se explicó principalmente a la disminución en las exportaciones de café sin tostar descafeinado o no; cáscara y cascarilla del café en -29,7% y artículos de confitería preparados con azúcar que no contengan cacao en -52,4%, con una contribución conjunta de -16,6 puntos porcentuales. Este comportamiento fue contrarrestado parcialmente por bananas frescas o secas en 17,2%, que contribuyó con 1,1 puntos porcentuales a la variación del grupo.

En noviembre de 2014 se exportaron 24,4 millones de barriles de petróleo crudo, frente a 20,6 millones de barriles en el mismo mes de 2015, lo que representó una disminución de 15,7%. La disminución en las ventas a Estados Unidos, India y Panamá restaron 21,6 puntos porcentuales a las exportaciones del país. No obstante, las ventas externas a Singapur sumaron 2,5 puntos porcentuales.

http://www.dane.gov.co/index.php/comercio-y-servicios/comercio-exterior/exportaciones

martes, 12 de enero de 2016

IMPORTING FOOD INTO AUSTRALIA

The Department of Agriculture and Water Resources is responsible for administering two sets of requirements with which imported food must comply. The first set of requirements address quarantine concerns. The second set of requirements address food safety and are those set out in the Imported Food Control Act 1992.All imported food must meet biosecurity requirements to be allowed into the country. Once imported food has met these requirements foods are monitored for compliance to the Australia New Zealand Food Standards Code.

QUARANTINEThe Quarantine Act 1908 requires that all imports of food comply with the quarantine conditions for their import. Quarantine restrictions apply to many raw foods and certain processed foods brought through the airport or mailed to Australia for private use. The following items are restricted:

- eggs and egg products

- dairy products

- uncanned meat

- seeds and nuts

- fresh fruit and vegetables

FOOD STANDARDS Like food that is produced domestically, food that is imported into Australia must meet Australian food standards. The monitoring of imported food is a responsibility shared across many government agencies, including those at local, state, territory and federal levels.

The food regulatory system in AustraliaPolicy decisions about food are made by the Australia New Zealand Food Regulation Ministerial Council which is chaired by the Minister for Health. This council, which includes Ministers for each state and territory government and the New Zealand government, receives policy advice from the Food Regulation Standing Committee (FRSC). This committee is chaired by the Department of Health. Relevant officials from state and territory and New Zealand food regulatory agencies are also represented on this committee.

Food Standards Australia New Zealand (FSANZ) is the government body responsible for developing and maintaining the Australia New Zealand Food Standards Code. Australian law requires all food to meet the food safety standards set out in the Food Standards Code. The Food Standards Code applies to all food offered for sale in Australia, whether produced domestically or imported.

FSANZ monitors food safety incidents worldwide and provides advice to the department on monitoring and testing imported food. FSANZ advises the department when food poses a medium-high risk to human health and on appropriate testing. It also provides risk assessment advice to state and territory regulators, who are responsible for monitoring all food at point of sale, including imported food.

The department's role in the monitoring of imported foodThe department's role to monitor imported food is part of a broader food regulatory system as discussed above.

Food entering Australia is subject to the Imported Food Control Act 1992, which provides for the inspection and control of imported food using a risk-based border inspection program, the Imported Food Inspection Scheme (IFIS). FSANZ advises the department on those foods that pose a medium to high risk to human health and safety, with the department classifying these foods as risk foods for inspection under the IFIS.

Role of state and territory authoritiesIn addition to the inspection activity undertaken at the border, state and territory authorities have responsibility for monitoring all food, including imported food, that is available for sale. Each state and territory authority has its own food legislation, which is based on the national Model Food Act developed by FSANZ and endorsed by the ANZFRMC. State and territory action on food is different from, but complementary to, that which occurs under the IFIS. On matters involving imported foods that has not been inspected or that have been found later not to be compliant, FSANZ, this department and the state and territory authorities work closely to address them.

Trans Tasman Mutual Recognition Arrangement (TTMRA)Under the Imported Food Control Act 1992, surveillance foods from New Zealand are exempt from the IFIS as these come under the Trans Tasman Mutual Recognition Arrangement (TTMRA).

The only New Zealand foods that are subject to the IFIS at the border are those classified as risk foods. Equivalence determination of food safety systems covering dairy products was reached in 2007 and seafood, uncooked pigmeat, chicken meat, coconut, pepper, paprika, peanuts and pistachios were aligned in 2011. This enabled these products to be brought under the TTMRA and removed the requirement for border inspection for these products.

Fuente: http://www.agriculture.gov.au/import/food

lunes, 11 de enero de 2016

Australia Imports from Colombia

Imports from Colombia in Australia remained unchanged at 6 AUD Million in February from 6 AUD Million in January of 2015. Imports from Colombia in Australia averaged 2.11 AUD Million from 1988 until 2015, reaching an all time high of 10 AUD Million in December of 2014 and a record low of 0 AUD Million in February of 1988. Imports from Colombia in Australia is reported by the Australian Bureau Of Statistics.

http://www.tradingeconomics.com/australia/imports-from-colombia

| Actual | Previous | Highest | Lowest | Dates | Unit | Frequency | ||

|---|---|---|---|---|---|---|---|---|

| 6.00 | 6.00 | 10.00 | 0.00 | 1988 - 2015 | AUD Million | Monthly |

Current prices NSA

|

This page includes a chart with historical data for Australia Imports from Colombia. Australia Imports from Colombia - actual data, historical chart and calendar of releases - was last updated on January of 2016.

Australia | Economic Indicators

| Overview | Last | Reference | Previous | Range | Frequency | ||

|---|---|---|---|---|---|---|---|

| GDP Growth Rate | 0.9 |

percent

| Sep/15 | 0.2 | -2 : 4.4 | Quarterly | |

| Unemployment Rate | 5.8 |

percent

| Nov/15 | 6.2 | 4 : 11.1 | Monthly | |

| Inflation Rate | 1.5 |

percent

| Sep/15 | 1.5 | -1.3 : 23.9 | Quarterly | |

| Interest Rate | 2 |

percent

| Dec/15 | 2 | 2 : 17.5 | Daily | |

| Balance of Trade | -2906 |

AUD Million

| Nov/15 | -3247 | -3912 : 2229 | Monthly | |

| Government Debt to GDP | 33.88 |

percent

| Dec/14 | 30.9 | 9.7 : 33.88 | Yearly | |

| Markets | Last | Reference | Previous | Range | Frequency | ||

|---|---|---|---|---|---|---|---|

| Currency | 0.7 | Jan/16 | 0.7 | 0.48 : 1.1 | Daily | ||

| Stock Market | 4967 |

points

| Jan/16 | 4965 | 1358 : 6829 | Daily | |

| Government Bond 10Y | 2.75 |

percent

| Jan/16 | 2.78 | 2.27 : 16.4 | Daily | |

| GDP | Last | Reference | Previous | Range | Frequency | ||

| GDP Growth Rate | 0.9 |

percent

| Sep/15 | 0.2 | -2 : 4.4 | Quarterly | |

| GDP Annual Growth Rate | 2.5 |

percent

| Sep/15 | 2 | -3.4 : 9 | Quarterly | |

| GDP | 1454 |

USD Billion

| Dec/14 | 1560 | 18.6 : 1560 | Yearly | |

| GDP Constant Prices | 411643 |

AUD Million

| Sep/15 | 407805 | 60536 : 411643 | Quarterly | |

| Gross National Product | 386409 |

AUD Million

| Sep/15 | 386067 | 53966 : 388716 | Quarterly | |

| Gross Fixed Capital Formation | 99722 |

AUD Million

| Sep/15 | 103838 | 9292 : 111414 | Quarterly | |

| GDP per capita | 37828 |

USD

| Dec/14 | 37497 | 13398 : 37828 | Yearly | |

| GDP per capita PPP | 43219 |

USD

| Dec/14 | 42810 | 27899 : 43219 | Yearly | |

| GDP From Agriculture | 8733 |

AUD Million

| Sep/15 | 9047 | 3045 : 9321 | Quarterly | |

| GDP From Construction | 31582 |

AUD Million

| Sep/15 | 30606 | 7506 : 31720 | Quarterly | |

| GDP From Manufacturing | 25033 |

AUD Million

| Sep/15 | 24724 | 14947 : 27976 | Quarterly | |

| GDP From Mining | 36217 |

AUD Million

| Sep/15 | 34232 | 5812 : 36217 | Quarterly | |

| GDP From Public Administration | 21535 |

AUD Million

| Sep/15 | 21651 | 7323 : 21651 | Quarterly | |

| GDP From Utilities | 10971 |

AUD Million

| Sep/15 | 10719 | 3936 : 11003 | Quarterly | |

| Labour | Last | Reference | Previous | Range | Frequency | ||

| Unemployment Rate | 5.8 |

percent

| Nov/15 | 6.2 | 4 : 11.1 | Monthly | |

| Employed Persons | 11901 |

Thousand

| Nov/15 | 11838 | 5994 : 11901 | Monthly | |

| Unemployed Persons | 739 |

Thousand

| Nov/15 | 740 | 365 : 953 | Monthly | |

| Full Time Employment | 41600 | Nov/15 | 38500 | -73016 : 76972 | Monthly | ||

| Part Time Employment | 29700 | Nov/15 | 7110 | -76610 : 75730 | Monthly | ||

| Employment Change | 71400 |

Persons

| Nov/15 | 56100 | -69614 : 90140 | Monthly | |

| Labor Force Participation Rate | 65.3 |

percent

| Nov/15 | 65 | 60.15 : 65.8 | Monthly | |

| Youth Unemployment Rate | 12.44 |

percent

| Nov/15 | 12.23 | 7.61 : 20.22 | Monthly | |

| Labour Costs | 101 |

Index Points

| Sep/15 | 102 | 45.4 : 102 | Quarterly | |

| Productivity | 101 |

Index Points

| Sep/15 | 102 | 58.2 : 104 | Quarterly | |

| Job Vacancies | 160 |

Thousand

| Sep/15 | 157 | 28.4 : 190 | Quarterly | |

| Job Advertisements | 155704 | Dec/15 | 156187 | 72582 : 257904 | Monthly | ||

| Wages | 1137 |

AUD/Week

| Jun/15 | 1129 | 59.1 : 1137 | Quarterly | |

| Minimum Wages | 657 |

AUD/week

| Dec/15 | 641 | 544 : 657 | Yearly | |

| Wage Growth | 2.3 |

percent

| Sep/15 | 2.5 | 2.3 : 4.3 | Quarterly | |

| Wages In Manufacturing | 1259 |

AUD/Week

| Jun/15 | 1268 | 333 : 1268 | Quarterly | |

| Population | 23.49 |

Million

| Dec/14 | 23.13 | 10.28 : 23.49 | Yearly | |

| Retirement Age Women | 64.5 | Dec/15 | 64.5 | 62 : 64.5 | Yearly | ||

| Retirement Age Men | 65 | Dec/15 | 65 | 65 : 65 | Yearly | ||

| Employment Rate | 61.55 |

percent

| Nov/15 | 61.27 | 53.48 : 63.41 | Monthly | |

| Prices | Last | Reference | Previous | Range | Frequency | ||

| Inflation Rate | 1.5 |

percent

| Sep/15 | 1.5 | -1.3 : 23.9 | Quarterly | |

| Inflation Rate Mom | 0.5 |

percent

| Sep/15 | 0.7 | -1.54 : 7.55 | Quarterly | |

| Consumer Price Index CPI | 108 |

Index Points

| Sep/15 | 108 | 4.2 : 108 | Quarterly | |

| Core Consumer Prices | 109 |

Index Points

| Sep/15 | 108 | 43.4 : 109 | Quarterly | |

| Core Inflation Rate | 2.07 |

percent

| Sep/15 | 1.98 | 0.87 : 7.6 | Quarterly | |

| GDP Deflator | 99.1 |

Index Points

| Sep/15 | 99.2 | 6.6 : 100 | Quarterly | |

| Producer Prices | 106 |

Index Points

| Sep/15 | 105 | 70.7 : 105 | Quarterly | |

| Producer Prices Change | 1.7 |

percent

| Sep/15 | 1.1 | -1.5 : 6.3 | Quarterly | |

| Export Prices | 80.9 |

Index Points

| Sep/15 | 80.9 | 16.3 : 112 | Quarterly | |

| Import Prices | 108 |

Index Points

| Sep/15 | 106 | 51.5 : 116 | Quarterly | |

| Food Inflation | 0.2 |

percent

| Sep/15 | 1.3 | -3.2 : 20.6 | Quarterly | |

| Money | Last | Reference | Previous | Range | Frequency | ||

| Interest Rate | 2 |

percent

| Dec/15 | 2 | 2 : 17.5 | Daily | |

| Interbank Rate | 2.53 |

percent

| Dec/15 | 2.74 | 2.4 : 18.18 | Monthly | |

| Money Supply M0 | 95.74 |

AUD Billion

| Nov/15 | 93.39 | 4.09 : 95.74 | Monthly | |

| Money Supply M1 | 321011 |

AUD Million

| Nov/15 | 317652 | 8246 : 335123 | Monthly | |

| Money Supply M3 | 1836573 |

AUD Million

| Nov/15 | 1823441 | 10191 : 1836573 | Monthly | |

| Banks Balance Sheet | 3931 |

AUD Billion

| Sep/15 | 3746 | 323 : 3931 | Quarterly | |

| Central Bank Balance Sheet | 154508 |

AUD Million

| Jan/16 | 154613 | 30418 : 167914 | Weekly | |

| Foreign Exchange Reserves | 67440 |

AUD Million

| Dec/15 | 68208 | 1126 : 84610 | Monthly | |

| Loans to Private Sector | 827143 |

AUD Million

| Nov/15 | 824283 | 20212 : 827143 | Monthly | |

| Deposit Interest Rate | 2.9 |

percent

| Dec/14 | 3.25 | 2.9 : 15.69 | Yearly | |

| Trade | Last | Reference | Previous | Range | Frequency | ||

| Balance of Trade | -2906 |

AUD Million

| Nov/15 | -3247 | -3912 : 2229 | Monthly | |

| Exports | 26764 |

AUD Million

| Nov/15 | 26604 | 435 : 29190 | Monthly | |

| Imports | 29670 |

AUD Million

| Nov/15 | 29852 | 396 : 29852 | Monthly | |

| Current Account | -18104 |

AUD Million

| Sep/15 | -20506 | -20882 : 295 | Quarterly | |

| Current Account to GDP | -2.8 |

percent

| Dec/14 | -3.3 | -6.7 : 1.4 | Yearly | |

| External Debt | 1907269 |

AUD Million

| Sep/15 | 1815720 | 147312 : 1907269 | Quarterly | |

| Terms of Trade | 83.3 |

Index Points

| Sep/15 | 82.6 | 49.3 : 118 | Quarterly | |

| Capital Flows | 18753 |

AUD Million

| Sep/15 | 15552 | -375 : 21907 | Quarterly | |

| Foreign Direct Investment | 57525 |

AUD Million

| Dec/14 | 56183 | -37050 : 57932 | Yearly | |

| Tourist Arrivals | 624000 | Oct/15 | 571500 | 30100 : 806700 | Monthly | ||

| Gold Reserves | 79.85 |

Tonnes

| Sep/15 | 79.84 | 79.69 : 79.85 | Quarterly | |

| Crude Oil Production | 301 |

BBL/D/1K

| Jun/15 | 258 | 258 : 781 | Monthly | |

| Terrorism Index | 3.11 | Dec/14 | 0.22 | 0.01 : 3.11 | Yearly | ||

| Government | Last | Reference | Previous | Range | Frequency | ||

| Government Debt to GDP | 33.88 |

percent

| Dec/14 | 30.9 | 9.7 : 33.88 | Yearly | |

| Government Budget | -3.1 |

percent of GDP

| Dec/14 | -1.2 | -4.2 : 2 | Yearly | |

| Government Budget Value | -2790 |

AUD Million

| Nov/15 | -4991 | -13933 : 13995 | Monthly | |

| Government Spending | 73344 |

AUD Million

| Sep/15 | 72817 | 8992 : 73344 | Quarterly | |

| Government Revenues | 31190 |

AUD Million

| Nov/15 | 37295 | 510 : 44914 | Monthly | |

| Fiscal Expenditure | 34159 |

AUD Million

| Nov/15 | 35810 | 790 : 45954 | Monthly | |

| Asylum Applications | 1787 |

Persons

| Dec/14 | 1787 | 118 : 1787 | Monthly | |

| Credit Rating | 97.31 | : | Monthly | ||||

| Business | Last | Reference | Previous | Range | Frequency | ||

| Business Confidence | 5 | Nov/15 | 3 | -30 : 20 | Monthly | ||

| Manufacturing PMI | 51.9 | Dec/15 | 52.5 | 30.86 : 62.13 | Monthly | ||

| Services PMI | 46.3 |

Index Points

| Dec/15 | 48.2 | 39 : 55.6 | Monthly | |

| Industrial Production | 2.18 |

percent

| Aug/15 | 0.29 | -7.8 : 12.77 | Quarterly | |

| Industrial Production Mom | -1.2 |

percent

| Jun/15 | 1.13 | -7.02 : 5.3 | Quarterly | |

| Manufacturing Production | -0.92 |

percent

| Aug/15 | -1.84 | -11.77 : 8.63 | Quarterly | |

| Capacity Utilization | 80.86 |

percent

| Nov/15 | 81.38 | 78.24 : 84.67 | Monthly | |

| New Orders | 15 | Dec/15 | 37 | -37 : 47 | Quarterly | ||

| Changes in Inventories | -411 |

AUD Million

| Sep/15 | 145 | -4069 : 4143 | Quarterly | |

| Bankruptcies | 872 |

Companies

| Nov/15 | 1000 | 217 : 1123 | Monthly | |

| Corporate Profits | 64619 |

AUD Million

| Sep/15 | 62842 | 12032 : 70734 | Quarterly | |

| Car Production | 14822 |

Units

| Nov/15 | 15132 | 9227 : 39306 | Monthly | |

| Car Registrations | 13297 |

Thousand

| Dec/14 | 13000 | 3991 : 13297 | Yearly | |

| Total Vehicle Sales | 97696 | Nov/15 | 96687 | 48099 : 100421 | Monthly | ||

| Leading Economic Index | 97.55 |

Index Points

| Nov/15 | 97.74 | 97.19 : 103 | Monthly | |

| Small Business Sentiment | -2.26 | Sep/15 | -2.32 | -21.1 : 18.71 | Quarterly | ||

| Business Inventories | 0.1 |

Percent

| Sep/15 | 0.2 | -2.7 : 2.9 | Quarterly | |

| Competitiveness Index | 5.15 |

Points

| Dec/16 | 5.08 | 5.08 : 5.2 | Yearly | |

| Competitiveness Rank | 21 | Dec/16 | 22 | 15 : 22 | Yearly | ||

| Corruption Index | 80 |

Points

| Dec/14 | 81 | 80 : 88.6 | Yearly | |

| Corruption Rank | 11 | Dec/14 | 9 | 7 : 13 | Yearly | ||

| Ease of Doing Business | 13 | Dec/15 | 12 | 9 : 15 | Yearly | ||

| Mining Production | 6.24 |

percent

| Aug/15 | 5.11 | -16.61 : 25.48 | Quarterly | |

| Consumer | Last | Reference | Previous | Range | Frequency | ||

| Consumer Confidence | 101 | Dec/15 | 97.8 | 64.61 : 128 | Monthly | ||

| Retail Sales MoM | 0.4 |

percent

| Nov/15 | 0.6 | -10.6 : 8.1 | Monthly | |

| Retail Sales YoY | 4.1 |

percent

| Nov/15 | 3.9 | 2.05 : 12.73 | Monthly | |

| Consumer Spending | 228840 |

AUD Million

| Sep/15 | 227171 | 32048 : 228840 | Quarterly | |

| Disposable Personal Income | 280915 |

AUD Million

| Sep/15 | 277349 | 3108 : 280915 | Quarterly | |

| Personal Savings | 9 |

percent

| Sep/15 | 8.8 | -0.7 : 20.6 | Quarterly | |

| Consumer Credit | 2411610 |

AUD Million

| Nov/15 | 2400371 | 35835 : 2411610 | Monthly | |

| Private Sector Credit | 0.4 |

percent

| Nov/15 | 0.7 | -0.5 : 2.9 | Monthly | |

| Bank Lending Rate | 8.8 |

percent

| Dec/15 | 8.8 | 8.1 : 20.5 | Monthly | |

| Gasoline Prices | 0.87 |

USD/Liter

| Dec/15 | 0.91 | 0.46 : 1.67 | Monthly | |

| Households Debt To Gdp | 122 |

percent of GDP

| Jun/15 | 120 | 34.2 : 122 | Quarterly | |

| Housing | Last | Reference | Previous | Range | Frequency | ||

| Building Permits | -12.7 |

percent

| Nov/15 | 7.9 | -23.91 : 32.3 | Monthly | |

| New Home Sales | 7463 | Oct/15 | 7708 | 5186 : 20768 | Monthly | ||

| Housing Index | 2 |

percent

| Sep/15 | 2 | -2.6 : 6.1 | Quarterly | |

| Construction Output | -3.6 |

percent

| Sep/15 | 2.1 | -18.9 : 9.2 | Quarterly | |

| Construction Pmi | 46.8 |

Index Points

| Dec/15 | 50.7 | 29.24 : 59.1 | Monthly | |

| Home Ownership Rate | 67 |

percent

| Dec/11 | 68.9 | 67 : 71.4 | Yearly | |

| Taxes | Last | Reference | Previous | Range | Frequency | ||

| Corporate Tax Rate | 30 |

percent

| Dec/15 | 30 | 30 : 49 | Yearly | |

| Personal Income Tax Rate | 45 |

percent

| Dec/14 | 45 | 45 : 47 | Yearly | |

| Sales Tax Rate | 10 |

percent

| Dec/15 | 10 | 10 : 10 | Yearly | |

| Social Security Rate | 11.25 |

percent

| Dec/15 | 10.75 | 10.5 : 11.25 | Yearly | |

| Social Security Rate For Companies | 9.25 |

percent

| Dec/15 | 9.25 | 9 : 9.25 | Yearly | |

| Social Security Rate For Employees | 2 |

percent

| Dec/15 | 1.5 | 1.5 : 2 | Yearly |

Suscribirse a:

Comentarios (Atom)